LEARN HOW OUR TALENTED TEAM CAN HELP YOUR BRAND TODAY.

WINNING WITH NEW PRODUCTS REMAINS VITAL

As part of our primary research program and in collaboration with Foodmix, Affinity Group sales associates recently completed live conversation surveys with 1,135 commercial foodservice operators across North American to gain key insights on the path to purchase new products.

The purpose of this white paper is to provide our valued clients with a management summary of the operator research supporting the overall conclusion that “Winning With New Products Remains Vital” for operators and manufactures. For this summary, the following 7 key insights are presented:

- Demand for New Products Remains High

- The Value Proposition Must Be Strong and Discernible

- Financial Impact, Culinary Considerations, and Availability are Critical

- The Path to Purchase Begins with the Operator’s Community

- Virtual Selling is Here to Stay, But Current Satisfaction is Very Low

- The Role and Significance of Sales Associates Must Not Be Overlooked

- Effective Social Media Strategies and Now a Must

1. Demand for New Products Remains High

While many operators have reduced menu complexity and streamlined their operations in the recent past, relevant and impactful new products – food, equipment, and supplies – continue to be in high demand.

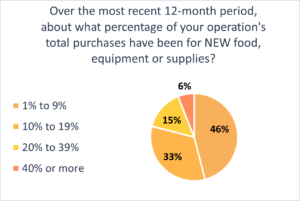

54% of operators surveyed reported that at least 10% of their total purchases were for new food, equipment, and supplies. 21% of these operators indicated that new items represented over 20% of total purchases. The successful development and launch of new products remain vital to the long-term success of both operators and manufacturers and should be a continual source of investment and focus.

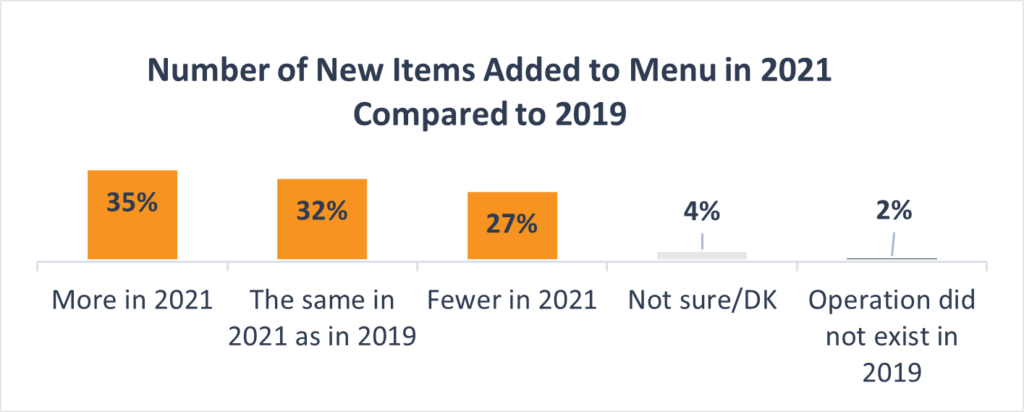

While it was broadly reported that many operators streamlined their menus during the pandemic, our data suggests a renewed focus on new menu items on par or greater than in 2019. For manufacturers, developing relevant new products with a strong value proposition and a ‘selling to the menu’ approach where applicable are reemerging as keys to successful operator selling.

2. The Value Proposition Must Be Strong and Discernible

For many operators, and arguably manufacturers as well, new products and the innovations represented are vital for growth and sustained success while also containing costs and increasing operational efficiencies.

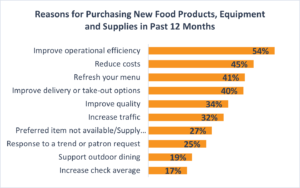

While it starts with quality, there are various other factors that operators consider as part of a new item’s value proposition as illustrated with the chart below. It is clear that the increased emphasis on delivery and take-out sales have strongly influenced recent operator new product needs. Leveraging and promoting new products as relative and impactful to one or more of these objectives can raise operator interest and purchase intent. And as the economy continues to improve, we would expect the factors listed on the bottom half of this chart to become more proactive and increase in importance.

3. Financial Impact, Culinary Considerations, and Availability are Critical

While operators want quality supported with a compelling value proposition, their valuation of potential new products include critical financial assessments, culinary and menu dynamics, and consistent availability from current sources.

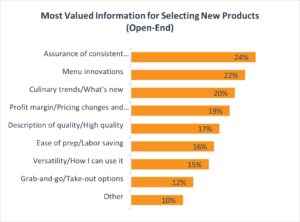

As illustrated in the nearby chart, 42% of operators view culinary considerations – including menu innovations and current and emerging trends – as critical information when selecting new products. Availability is also critical information as operators seek to understand any barriers or issues to obtaining the desired new items. Whether through traditional or alternative sources, the challenge remains for manufacturers to establish effective operator access to new products. While the question of “does my distributor carry it” has always been part of the consideration set – the promotion of availability as a prime concern has likely been elevated by the supply chain issues resulting from the pandemic. Further, culinary benefits and market trends combined with consumer appeal are increasingly important factors within operator assessments of new items.

Get free access to our most inspiring thought leadership research on issues that are shaping the future of the foodservice and retail food industry!

4. The Path To Purchase Begins with the Operator’s Community

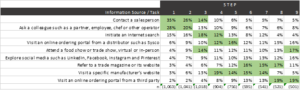

Contacting a salesperson or asking a colleague remain highly influential for operators in the initial steps followed by an internet search and visiting an online ordering portal provided by a distributor.

With the chart below, operators were asked to prioritize the information sources typically used when considering new items. As illustrated, the operator’s community offers many inputs, but engaging a sales person or a colleague continue to be highly influential after some foundational information is obtained from searching the internet or their distributor’s portal.

With the competitiveness of the industry and current dynamics, there is a heightened emphasis on maximizing guest satisfaction to drive traffic or raise check averages. For this reason, the influence of the operators’ customers with relevant insights also remains paramount. Similarly, operators are also open to input from suppliers, colleagues, and employees while social media continues to gain in influence. The data suggests the voice of the consumer is critical to the manufacturer’s selling story, especially with new products. A further insight is that manufacturers should also not underestimate their ability to influence operators with relevant and compelling recommendations. Additionally, the data suggests that social media and the use of an influencer strategy has reached a new level of impact commensurate with food and trade shows.

How much does each of the following influence you to add a new food product?

5. Virtual Selling is Here to Stay, But Current Satisfaction is Very Low

Although in-person events and direct contact will return, virtual selling is expected to continue, but improvements are needed to better satisfy operator needs.

While 64% of operators – a meaningful level of participants – indicated attending a virtual trade event of show in the last 12 months, only 1 in 5 were satisfied with the event or show as a good source of information. While virtual trade events and shows have thus far had limited success providing operators with salient information and ideas relevant to new products, the data also suggest such events will only increase in importance and need to be an effective sales tool. Clearly, there are challenges here for manufacturers, and we would suggest that allocating the necessary resources to virtual events as part of the marketing mix be given stronger consideration.

6. The Role and Significance of the Sales Reps Must Not Be Overlooked

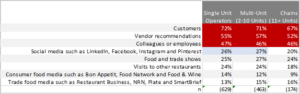

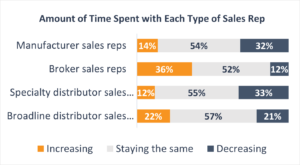

This research strongly suggests that in-person selling at the point of operator contact remains critical not only to driving success with new products, but to the manufacturer’s overall marketing mix and go-to-market approach.

While challenged, operators are still spending meaningful, time with sales associates. While there are several ways to interpret the information found in this study, the bar has been raised and any interaction with operators must be highly efficient and worthy of their time. Part of this includes the pre-planning and diligence of matching the new item to the target market as part of the commercialization and launch process.

While we must acknowledge that there may be some respondent bias here, in that this survey was fielded by Affinity Group sales associates, the challenge with efficiency versus effectiveness of in-person selling particularly at the local and regional level remains. Our interpretation of the data is that in-person selling or personal touch points remain vital to targeted operator selling and can be especially effective when trying to penetrate the market with new items. We would argue that all operator selling – especially at the local and regional levels – increasingly requires the use and leverage of data and analytics to first identify the target market that represents the highest likelihood of success. Utilizing this information to determine the most appropriate allocation of resources will improve both the efficiency and effectiveness of selling new items to operators.

New product success will increase with well trained and knowledgeable front-line sellers. In terms of usage frequency for information and ideas on new products, broker and distributor sales associates rate the highest when considering the top 2 box scores. As before, this again speaks to the need for highly effective commercialization and launch plans that fully leverage the operator reach and influence that the broker and distributor associates can provide. As manufacturers consider all elements of their marketing mix and go-to-market approach with new products, this data suggest manufacturers should not underestimate the importance of in-person selling and relationships as keys to maximizing new product success. The data clearly suggests that operators value what the broker sales associates provide.

7. Effective Social Media Strategies are Now a Must

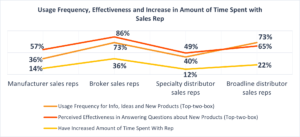

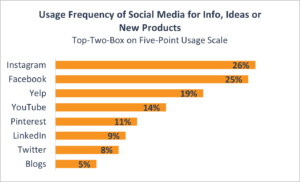

Instagram, Facebook, and other social media have emerged as important influences in operator decisions and should be incorporated into the manufacturer’s marketing mix.

Fully 1 in 4 operators are frequently using Instagram and/or Facebook to find information and ideas for new products for their operations. A strong presence on these platforms is critical to manufacturers who hope to inform and influence operators, especially the youngest operators. This trend has reached a substantive level that requires specific and compelling planning and use not only in support of new product introductions, but also as a core element of the marketing mix of manufacturers. Whether trying to penetrate the market with new products, creating demand for your brands, or driving consumption of your ingredients, well developed and effectively executed social media strategies can have a meaningful direct and interactive effect with all other marketing mix elements and your go-to-market approach.

Conclusion

There is a strong belief with many that to win in the food industry, it is critical to also win with new product innovation; that new products are vital to all levels and segments within the channel. As confirmed with this research, it is no surprise that the operator path to purchase requires a strong and discernible value proposition that effectively addresses multiple needs. This certainly underscores the challenges of generating the desired success of true new product innovation.

With the 7 key take-aways summarized herein, we hope that valuable insights have been provided that can influence your new product development plans and commercialization strategies.

As your bridge to success, Affinity Group hopes to continue this conversation and as available, assist with the development of a robust plan and go-to-market approach that effectively activates our sales and culinary resources to get your new items placed with targeted operators and drive your success. Let us know how we can help support your efforts.